Recent Water Damage Posts

Restoring Landscaping After Water Damage: Lawn, Garden, and Soil

3/12/2025 (Permalink)

Water damage can wreak havoc on landscaping in North Carolina, leaving homeowners frustrated and unsure where to start the restoration process.

Water damage can wreak havoc on landscaping in North Carolina, leaving homeowners frustrated and unsure where to start the restoration process.

Water damage can wreak havoc on landscaping in North Carolina, leaving homeowners frustrated and unsure where to start the restoration process. Whether the damage comes from heavy rains, flooding, or a burst pipe, restoring your lawn, garden, and soil requires careful planning and expert insights. Here’s a comprehensive guide to help you bring your outdoor space back to life after water damage.

Assessing Water Damage to Landscaping

Before diving into restoration, it’s essential to assess the extent of the damage. Water can erode soil, suffocate plant roots, and lead to nutrient imbalances. Here’s how to evaluate your landscape:

- Check for Erosion: Look for displaced soil, gullies, or exposed roots.

- Inspect Your Lawn: Standing water can cause root rot, and excessive moisture can lead to patchy, dying grass.

- Evaluate Garden Plants: Some plants can withstand temporary flooding, while others may need to be replaced.

- Test Soil Conditions: Excess water can strip the soil of essential nutrients, requiring amendments before replanting.

By identifying specific issues early, you can create an effective restoration plan.

Restoring Your Lawn After Water Damage

A water-damaged lawn requires attention to drainage, soil health, and proper seeding or sod replacement. Follow these steps to revive your lawn:

- Improve Drainage: If poor drainage causes water pooling, aerate the lawn to allow oxygen and water movement.

- Remove Debris: Clear away silt, mud, and any dead grass to prevent fungal issues.

- Aerate the Soil: Compacted soil prevents healthy root growth; aeration improves water absorption.

- Apply Topsoil and Fertilizer: Replenish lost nutrients with high-quality topsoil and organic fertilizer.

- Reseed or Lay Sod: Depending on the damage, overseeding or replacing sod can help restore lush green grass.

- Monitor and Water Wisely: Keep soil moist but avoid overwatering, allowing roots to establish properly.

Reviving Your Garden After Flooding

Gardens are often the most sensitive areas in landscaping when it comes to water damage. Here’s how to restore your flower beds and vegetable patches:

- Prune or Remove Damaged Plants: Trim back plants with waterlogged roots or remove those that are beyond recovery.

- Flush Out Contaminants: If floodwater contains debris or chemicals, rinse plants and soil thoroughly.

- Replenish Nutrients: Mix in compost or organic matter to restore essential minerals.

- Check Mulch: Replace any washed-away mulch to maintain soil moisture and prevent erosion.

- Choose Resilient Plants: Consider replanting with species that tolerate excess moisture if flooding is a recurring issue.

Restoring Soil Health After Water Damage

Soil is the foundation of a thriving landscape, and excessive water can deplete its quality. Here’s how to restore soil after water damage:

- Test Soil pH and Nutrients: Conduct a soil test to determine deficiencies caused by water saturation.

- Amend the Soil: Add organic matter, sand, or gypsum to improve aeration and drainage.

- Aerate Compacted Soil: Use a garden fork or aeration tool to loosen the soil and improve oxygen flow.

- Prevent Future Erosion: Install erosion-control measures such as retaining walls or ground cover plants.

Healthy soil ensures long-term recovery and growth for your entire landscape.

FAQs: Restoring Landscaping After Water Damage

Q: How long does it take for landscaping to recover from water damage?

A: Recovery time varies depending on the severity of the damage. Lawns may take a few weeks, while gardens can take a full season to regain their health.

Q: Can I reuse flood-damaged soil for planting?

A: Yes, but it’s essential to amend it with compost and conduct a soil test to address any nutrient imbalances.

Q: What types of plants are most resistant to water damage?

A: Plants like ferns, ornamental grasses, and certain perennials such as hostas can tolerate excessive moisture better than others.

Q: Should I replace my lawn after severe flooding?

A: In some cases, replacing sections with new sod or reseeding may be necessary if the grass has rotted beyond recovery.

Q: How can I prevent future water damage to my landscaping?

A: Improve drainage, use erosion control methods, and choose plants suited for your climate and soil conditions.

Restoring landscaping after water damage requires patience and a strategic approach. By assessing the damage, improving soil health, and carefully replanting, you can bring your lawn and garden back to life. Whether it’s reviving a soggy lawn, restoring a flooded garden, or enriching nutrient-depleted soil, these expert tips will help homeowners get their landscapes thriving once again.

For professional water damage restoration and expert landscaping recovery services, consider reaching out to SERVPRO® to ensure your outdoor space gets the care it needs.

Water Damage and Financial Recovery: Rebuilding Your Finances

10/16/2024 (Permalink)

Water damage can strike unexpectedly, leaving homeowners and business owners facing not only the immediate challenges of cleanup but also the long-term financial burden of repairs and recovery. While the physical damage can be overwhelming, understanding how to rebuild your finances after such an event is crucial. This blog aims to guide you through the steps to take after experiencing water damage, helping you regain financial stability.

Assessing the Damage and Contacting Your Insurance Provider

The first step in financial recovery after water damage is to thoroughly assess the extent of the damage. This involves documenting everything, from structural damage to personal belongings. Photographs and detailed notes will be invaluable when it comes to filing an insurance claim. Once you have a clear picture of the damage, it’s essential to contact your insurance provider as soon as possible.

Most homeowners’ insurance policies cover water damage, but the coverage details can vary. Understanding your policy and knowing what is covered will help you navigate the claims process more effectively. Your insurance company may send an adjuster to assess the damage and determine the payout. Having all necessary documentation ready can speed up this process, ensuring you receive the funds you need for repairs and restoration.

Budgeting for Repairs and Restoration

Even with insurance coverage, there may be out-of-pocket expenses to consider. Creating a detailed budget for repairs and restoration is crucial to managing these costs. Start by obtaining quotes from reputable contractors, ensuring you have a clear understanding of what each service entails and the associated costs.

It’s also wise to factor in unexpected expenses. Water damage can reveal underlying issues, such as mold or structural weaknesses, which may require additional repairs. Allocating funds for these potential surprises will help prevent financial strain as you move forward with the restoration process.

Exploring Financial Assistance Options

If your insurance coverage doesn’t fully cover the cost of repairs, or if you’re facing significant out-of-pocket expenses, exploring financial assistance options may be necessary. This can include personal loans, home equity lines of credit, or government aid programs designed to assist those affected by natural disasters.

Some community organizations or charities may also offer financial support or low-interest loans for homeowners in need. Researching these options and understanding the terms and conditions will help you make informed decisions as you rebuild your finances.

Planning for the Future

Once the immediate financial impact of water damage has been addressed, it’s important to consider long-term financial planning. This can include reviewing and possibly updating your insurance policy to ensure better coverage in the future, as well as establishing an emergency fund to handle unexpected expenses.

Investing in preventive measures, such as improved drainage systems or water-resistant materials, can also help protect your property from future water damage, potentially reducing the risk of financial loss.

Recovering from water damage involves more than just physical repairs; it requires careful financial planning and decision-making. By assessing the damage, understanding your insurance coverage, budgeting for repairs, exploring financial assistance, and planning for the future, you can rebuild your finances and move forward with confidence.

Tips for Successful Water Extraction

6/25/2024 (Permalink)

As a homeowner, encountering water damage can be a distressing experience. Whether it’s from a burst pipe, flooding, or a leaky roof, the effects of water damage can wreak havoc on your property and possessions if not addressed promptly and effectively. At SERVPRO®, we understand the urgency of water extraction and the importance of taking immediate action to mitigate further damage. To help you navigate this challenging situation, we’ve compiled a list of essential tips for successful water extraction.

Act Fast

Time is of the essence when it comes to water damage. The longer water sits, the more extensive the damage becomes. As soon as you notice water intrusion, don't hesitate to contact a professional water restoration company like SERVPRO. Our team is available 24/7 to respond swiftly to emergencies and start the extraction process immediately.

Ensure Safety

Before attempting any water extraction yourself, prioritize safety. Turn off the electricity to the affected area to avoid the risk of electrical shock. If the water damage is extensive or contaminated, it’s best to wait for trained professionals to handle the extraction process safely.

Assess the Damage

Once it’s safe to do so, assess the extent of the water damage. Identify the source of the water intrusion and take note of any areas that are particularly saturated. This information will help our technicians tailor the extraction process to effectively address the specific needs of your property.

Remove Standing Water

Using specialized equipment such as pumps and extractors, our technicians will swiftly remove standing water from your property. Our state-of-the-art tools ensure thorough extraction, minimizing the risk of secondary damage such as mold growth and structural deterioration.

Dry and Dehumidify

After removing standing water, the drying process begins. Our technicians utilize industrial-grade air movers and dehumidifiers to accelerate drying times and restore optimal humidity levels. Proper drying is crucial for preventing mold growth and preserving the integrity of your property.

Sanitize and Disinfect

Water damage often brings contaminants into your home, posing health risks to you and your family. Our team employs advanced cleaning and disinfection techniques to sanitize affected surfaces and restore a safe and healthy environment. From carpets and upholstery to walls and ceilings, we leave no stone unturned in our restoration efforts.

Monitor Progress

Even after the extraction and drying process is complete, it’s essential to monitor the affected areas for any signs of lingering moisture or mold growth. Our technicians will conduct thorough inspections to ensure that your property is fully restored to its preloss condition.

Successful water extraction requires prompt action, thorough assessment, and professional expertise. By following these tips and entrusting your water damage restoration to SERVPRO, you can expedite the recovery process and minimize the impact on your home and belongings. Don’t let water damage dampen your spirits—contact SERVPRO today for swift and reliable restoration services.

Flood Plains and Water Damage: What You Need to Know About Your Area

2/3/2024 (Permalink)

Living in a flood-prone area comes with unique risks and considerations. Understanding the concept of floodplains and their implications is crucial for homeowners. In this blog post, we will explore what floodplains are, their impact on water damage, and important information you need to know about your area to protect your home and make informed decisions.

Understanding Floodplains

Floodplains are low-lying areas adjacent to rivers, lakes, and other bodies of water that are prone to flooding. These areas serve as natural flood buffers and are designated based on historical flood data and hydrological analysis. Understanding if your property is located within or near a floodplain is essential information for assessing your vulnerability to water damage and obtaining flood insurance coverage.

Assessing Flood Risk

To assess the flood risk for your property, consult flood maps provided by the Federal Emergency Management Agency (FEMA) or local government agencies. These maps outline flood zones, including high-risk areas floodplains, and provide insights on the likelihood and severity of flooding. Understanding the flood risk level of your area will help you take appropriate preventive measures, such as securing flood insurance and implementing mitigation strategies.

Flood Insurance Coverage

Standard homeowners insurance policies typically do not cover flood damage. If your property is in a floodplain or at risk of flooding, it's essential to secure flood insurance. Consult with insurance agents or visit the National Flood Insurance Program (NFIP) website to understand the coverage options available to you. Remember, there may be a waiting period before flood insurance coverage takes effect, so don't wait until a flood warning is issued to purchase a policy.

Mitigation and Preparedness

Living in a flood-prone area requires proactive measures to reduce the risk and potential damage of flooding. Evaluate your property's vulnerability and implement necessary mitigation strategies such as elevating utilities, installing flood-resistant materials, and ensuring proper drainage. Develop a comprehensive emergency plan for your family, including the evacuation route and steps to protect valuables during a flood event.

Stay Informed and Alert

Flood risks and conditions can change rapidly, so staying informed is crucial. Sign up for local emergency alerts and heed warnings issued by authorities. Keep an eye on local weather reports that include flood watch or warning notifications. Familiarize yourself with evacuation procedures and the locations of emergency shelters in your area. Being prepared and alert will help you navigate flood events safely.

Engage with the Community

Understanding the flood risk and water damage implications of your area can be a collective effort. Engage with your local community and homeowners' associations to discuss flood mitigation initiatives, share experiences, and learn from one another. Participate in community workshops or meetings focused on floodplain management and get involved in efforts to improve your area's resilience to floods.

Recognizing the flood risk and understanding floodplains is crucial for homeowners residing in flood-prone areas. By assessing your vulnerability, securing flood insurance, implementing mitigation measures, and staying informed, you can better protect your home and minimize the impact of water damage caused by floods.

Water Damage and Home Value: How Restoration Affects Property Resale

10/15/2023 (Permalink)

Water damage can significantly impact a home's value and make it harder to sell.

Water damage can significantly impact a home's value and make it harder to sell.

Water damage is a homeowner's worst nightmare, as it can lead to costly repairs, hazards, and a decrease in property value. If left untreated, water damage can significantly impact a home's resale value and make it harder to sell. In this blog post, we'll examine how water damage can affect a home's value and how restoration efforts can positively impact property resale.

Water Damage and Home Value

Water damage can significantly reduce a home's resale value if not addressed promptly and effectively. Here are some ways water damage can impact property value:

- Structural Damage

Water damage can lead to structural damage to a home, leading to a decrease in property value. Structural damage can weaken the foundation, walls, floors, and roof, causing potential safety hazards to occupants.

- Cosmetic Damage

Water damage can cause cosmetic damage to a home, such as warped or stained flooring, peeling paint, and damaged wallpaper. These issues can make a home appear unattractive and less desirable to potential buyers, leading to a decrease in property value.

- Health and Safety Concerns

Water damage can lead to health and safety concerns, such as mold growth and exposure. Mold can cause respiratory issues, allergies, and other health problems. These concerns can dissuade potential buyers from purchasing a home, leading to a decrease in property value.

- Difficulty in Selling

Water damage can make it more challenging to sell a property, as potential buyers are likely to be deterred by the visible signs of damage and potential safety hazards. This can lead to longer periods on the market and price reductions, leading to a decrease in property value.

Water Damage Restoration and Property Resale

Water damage restoration is crucial in restoring a home's value and ensuring it is safe for occupancy. Proper restoration efforts can positively impact property resale in the following ways:

- Increase Property Value

Proper restoration efforts can increase a home's value by addressing the underlying issues that caused the water damage and restoring the property to its original condition. Restoration efforts, such as repairing or replacing damaged flooring, walls, and roofing, can improve a home's aesthetics and structural integrity, increasing its value.

- Improve Health and Safety

Restoration efforts, such as mold remediation and sanitization, can improve the indoor air quality, making it safe for occupancy. This can increase property value by alleviating any health and safety concerns potential buyers may have.

- Attract Potential Buyers

Proper restoration efforts can make a home attractive to potential buyers by ensuring it is in good condition. Restoration efforts can make a home appear more move-in ready, improve its curb appeal, and reduce the time it spends on the market.

- Insurance Claims and Coverage

Proper restoration efforts can often be covered by insurance, and a professional restoration company can help in filing the necessary claims. Having proper documentation of the restoration efforts can lead to potential buyers having more confidence in the property, leading to less difficulty in selling.

Water damage can significantly impact a home's value and make it harder to sell. However, proper restoration efforts can help restore the home to its original condition, improving its aesthetics, structural integrity, and making it safe for occupancy. Restoration efforts can positively impact property resale, increase its value, attract potential buyers, and lead to less difficulty in selling. If you're dealing with water damage, it's crucial to address it promptly and effectively to protect the property value and ensure the home's safety.

The Vital Importance of Regular Water Inspections

7/18/2023 (Permalink)

Water is an essential resource that we rely on for drinking, cooking, cleaning, and other daily activities. Ensuring the safety and quality of our water supply is of paramount importance to protect our health and well-being. Regular water inspections play a crucial role in identifying potential issues, preventing contamination, and maintaining a reliable water source. In this blog post, we will explore the significant reasons why regular water inspections are essential for every home and community.

Ensuring Drinking Water Safety

Regular water inspections help ensure the safety of our drinking water. Water sources can be susceptible to various contaminants, including bacteria, viruses, chemicals, and heavy metals. By conducting routine inspections, potential hazards can be detected early, and appropriate measures can be taken to address them. This helps to safeguard the health of individuals who rely on the water supply for consumption.

Identifying Plumbing Issues

Water inspections provide an opportunity to detect plumbing issues that may compromise the quality of the water. Leaky pipes, corroded fittings, or deteriorating infrastructure can introduce contaminants or lead to water loss. Regular inspections can help identify these problems and facilitate timely repairs, ensuring the integrity of the plumbing system and minimizing the risk of water contamination.

Preventing Waterborne Diseases

Waterborne diseases can spread rapidly if proper water quality measures are not in place. Pathogens such as bacteria, viruses, and parasites. Regular water inspections help monitor and control the presence of these disease-causing organisms, thereby reducing the risk of waterborne infections.

Compliance with Regulations and Standards

Water inspections are vital for ensuring compliance with local, state, and national regulations and standards. Regulatory bodies set guidelines for water quality, treatment, and testing to protect public health. Regular inspections help assess the water supply's adherence to these regulations, identify areas of improvement, and take corrective actions to meet the required standards.

Early Detection of Contamination Sources

Water sources can be vulnerable to contamination from various external factors. Industrial pollutants, agricultural runoff, improper waste disposal, and natural events like floods or landslides can introduce contaminants into water bodies. Regular inspections help monitor the water quality and identify potential sources of contamination. By detecting these issues early, prompt action can be taken to prevent further contamination and protect the environment.

Maintaining Water System Efficiency

Regular inspections contribute to the overall efficiency of the water system. Identifying leaks, optimizing water treatment processes, and monitoring system performance help conserve water, reduce wastage, and ensure efficient operation. This not only benefits the environment but also helps manage water resources effectively, especially in regions experiencing water scarcity.

Regular water inspections are essential for safeguarding public health, maintaining water quality, and complying with regulations. By conducting routine assessments, potential issues can be detected early, ensuring the safety and reliability of our water supply. From identifying contaminants and plumbing issues to preventing waterborne diseases and promoting system efficiency, water inspections play a critical role in ensuring the quality and sustainability of our water resources. Investing in regular water inspections is a proactive step towards maintaining a safe and reliable water supply for ourselves and future generations.

Will filing an insurance claim raise my rates?

3/8/2023 (Permalink)

If you're in an accident, file a claim with your insurance company. But will filing a claim raise your rates? The answer is complicated and depends on many factors. Your insurer might charge you more to make up for paying out money from the claim, or it might not change anything at all. To find out, first check with your insurer about whether filing a claim will affect your premiums at all. Then consider whether waiting until after the next time you renew your policy would be better than filing that claim now.

Insurance claims are common.

Claims are common. It's important to remember that this figure represents all claims across all types of insurance products, homeowners' policies as well as auto and life insurance policies.

In addition to providing valuable information about how much money was spent on claims during this time period (and therefore how much money could potentially flow into your pocket), these figures also show us just how common it is for people like yourself who have filed an insurance claim against their house after some sort of disaster or accident at home. If you're worried about whether filing one will affect future premiums based on what happened with another customer years ago who didn't pay off his debt until 2026...don't worry! Nowhere does it say, if someone else files a claim against their home then yours will cost more.

Insurance claim processing

Most insurance companies ask you to pay a deductible when you make a claim. A deductible is the amount of money that you must pay before your insurer will pay its share of the costs associated with repairing or replacing damaged property.

Claims take time to process. The insurance company has to verify the claim and make sure it's valid before they pay you. Once they do that, they'll pay out some money immediately (called "advanced payments") while waiting for contractors to complete the work and make sure everything was done correctly.

If your contractor isn't available right away or if there are complications with getting an estimate from them, this can delay things even further.

Claims can change your premiums.

Claims can change your premiums, but might not raise them for a long time. Insurance companies look at claims history when setting premiums, so if you make a claim, you may be charged higher rates for a few years. However, if you have a good track record with the company and have been with them for several years (which is why they gave you insurance in the first place), then they may give discounts on future policies or even offer new ones at lower rates.

Check with your insurance company.

Before filing a claim, it is important to check with your insurance company to determine how they handle claims. Some may have a policy of increasing rates after a claim has been made. Others will not raise premiums until the following year, but then keep those increased rates for 3 years or more. If you have had multiple claims within the past three years, this could be an indication that your driving record is not ideal and could result in higher premiums when purchasing new coverage.

The best way to know if filing a claim will raise your insurance rates is to contact your insurance company. Most of them will be able to tell you how claims affect premiums, and they may even offer special discounts for customers who have not filed any claims in the past few years.

10 Ways To Prevent Home Flooding & Water Damage

12/16/2022 (Permalink)

When it comes to your property, you must take steps to protect it.

When it comes to your property, you must take steps to protect it.

Prevent Home Flooding & Water Damage

If you're reading this, you're likely aware of the risks of flooding, especially if you live in an area that's prone to it. But even if your home isn't in a flood zone, a sudden storm or burst pipe can cause major damage and lead to a costly clean-up bill. To protect against water damage, it's important to take preventative measures like checking your gutters and windows regularly — and knowing when to call in the experts. Here are 10 steps that every homeowner should take to keep their property safe from flooding:

Check Your Gutters

Gutters are an overlooked part of many home maintenance routines. That's unfortunate, because when your gutters are clogged, damaged or leaking, you're at risk for water damage and other costly problems. A quick glance around the exterior of your home can tell you if there is any damage to the gutters that needs repair before winter hits.

Gutter guards can help keep leaves out of your gutter system and prevent clogs from forming. The best way to deal with them is by calling a professional who has experience working with this type of installation so they know where to place guards that will give you full protection during rainy season.

Check Your Windows

Check for cracks in the window frame. If you find any, replace them immediately to prevent water damage and mold growth inside your home.

Look for condensation on the inside of the window. This might indicate that it's time for a change of season or that there's a leak somewhere nearby — and if it's not just condensation, it could indicate a problem with the sealant around your windowsills or frames that needs to be fixed before too long. Inspect each window gasket for leaks around its edges and make sure they're in good condition (if they are old). This will help keep water from entering your home through cracks as well as keep out moisture from inside when it gets cold outside. Finally, check for stains on exterior walls near windows; these can indicate leaks onto exterior surfaces which may have occurred years ago but are still visible today!

Install a Sump Pump

You'll want to install a sump pump at the lowest point of your home. This can be in the basement or even an unfinished attic. It should be installed in a dry and accessible location so you can easily access it if it needs repair or maintenance. A sump pump will remove water from your basement, but you may also want to consider installing floodgates or other types of protection against flooding, depending on how much damage flooding has caused in the past and how often it occurs.

Seal Your Foundation

If you don't have a basement, you can still get water damage when it rains. Water enters through any gaps or openings in the foundation and can seep into the walls, causing mold and rot to form. To prevent this from happening, install a waterproofing sealant around window frames, doorways, and other openings that are not fully covered by siding or brickwork. A professional will be able to help you determine whether your home has been adequately sealed against water intrusion — and if not how best to remedy the situation.

Upgrade Old Appliances

- Replace old appliances.

- Check the energy efficiency of your appliances.

- Replace your water heater with a more efficient model.

- Check the efficiency of your refrigerator, dishwasher, and washing machine.

Insulate Water Pipes

Water pipes are a common source of water damage in the home, particularly during the winter when they are prone to freeze. To prevent this, you can insulate them. Insulating hot water pipes will reduce your energy consumption and help make your home more comfortable in the winter months. Hot water pipe insulation is very easy to install and can be done in just a few hours. If you have an attic, it's best to add insulation there because this is where most of your water pipes are located.

Protect Against Sewer Backups

Install a backwater valve. If you live in a high-risk area, you must have a backwater valve installed on your property. It will prevent sewage from backing up into your home if there is heavy rain or flooding in the area, which can lead to water damage and mold growth.

Assess Your Risk for Flooding

Before you do anything else, it's important to assess your risk for flooding. If you live in an area that is at risk for flooding, then it's essential that you familiarize yourself with what may happen and how to prevent it. The best way to protect yourself from flood damage is by knowing the signs of possible water damage and taking preventative measures before any actual damage occurs.

Check Your Local Weather Forecast

The first thing that you should do is check your local weather forecast. If heavy rains are on their way and predicted to occur within 24 hours or less, then this could be an indication that a storm drain system might overflow into your home due to high water levels in the streets. This can be especially problematic if there isn't proper drainage around your home (like gutters).

Elevate Appliances & Furniture

If there's a chance your couch could get wet in an apartment flood, place it on top of some plywood so that its legs don't get submerged. A heavy-duty plastic cushion can protect the fabric from moisture while keeping it elevated above any potential floodwaters on the floor below. If your rugs or area rugs are susceptible to water damage, move them off-site until they're needed again.

Buy Flood Insurance

Flood insurance is a type of insurance that covers damage to your property due to flooding. It also covers contents that were damaged in the flood and any additional living expenses incurred while repairs are made or if you need to temporarily move out of your home. If a flood occurs and you don't have flood insurance, you will be responsible for paying all costs associated with the cleanup and repairs yourself.

The good news is that many homeowners’ policies do include some coverage for flooding, but it's usually not enough to cover all the damages that can occur from this type of event. To get adequate coverage, you'll need to purchase separate flood insurance through an independent provider such as NFIP (National Flood Insurance Program).

We hope that this blog has helped you better understand what you can do to prevent water damage in the home. When it comes to your property, you must take steps to protect it. And while prevention is always better than cure, if something does happen, don’t panic! We have a team of experts at SERVPRO of Nantahala who can be there within hours with all the equipment needed for any type of emergency — and we promise we won’t leave until everything is back in order again.

How Do You Prevent a Water Damage?

11/1/2022 (Permalink)

Water damage in Franklin, NC

Water damage in Franklin, NC

How Do You Avoid Water Damage?

Water damage is one of the most common disasters in homes. It can happen to anyone at any time. However, there are many ways that you can prevent water damage in your Franklin, NC home.

First, do your water damage prevention upfront before you even buy your home.

The first thing you should do is to check your property for leaks. If there are any, they must be fixed before you move in.

After that, check the property for mold and water damage. Make sure that there are no signs of flood damage as well. This can often be a problem with properties located near a creek or river in areas prone to flooding during heavy rainfalls and spring thaws.

If you notice any of these signs, contact an inspector immediately before buying the home so that they can determine whether there is anything structurally wrong with it (and thus something worth fixing prior to purchase). You’ll also want to make sure that any necessary repairs have been done already (you don't want to buy a house only after finding out there's mold growing everywhere) and that proper measures have been taken against future damage by ensuring insulation around pipes or other essential household.

Second, call SERVPRO of Nantahala and have them come out and inspect your home.

The second thing that you can do is to call SERVPRO of Nantahala, or another water damage restoration company and have them come out and inspect your home. They're going to be able to see all the damage that has occurred and then they'll give you a free estimate on how much it will cost to dry out your home. Once they have inspected your property, they can help you get started on getting things repaired quickly so that you can move back in as soon as possible.

Third, have some sort of insurance in place.

Number Three is to have some sort of insurance in place, whether it's through your homeowners policy or a different policy that can protect you from water damages as well as fires.

Talk with your insurance company about what kind of coverage you have and how much coverage you need. The more assets that require protection against water damage and fire, the more coverage will be needed. If there's any doubt about whether your home has adequate fire or flood insurance, contact an agent today!

Fourth, check the pipes in between the furnace and the hot water heater.

- Now if you've got an older home, those pipes can get cold. And if they're not insulated properly or they are touching each other, then you can get a freeze there and then when that happens it'll burst your pipe. So, you want to make sure that there's plenty of space between them so it doesn't happen again.

- Also make sure there isn't any water around those pipes because if there is, then it's going to freeze during those cold winter months and burst your pipe too. So, we recommend having an electric heater running down here too just so that keeps everything nice and warm so nothing freezes up on us when we're not looking for these things!

Fifth, make sure that your hot water heater is protected and up to code.

One of the most common causes of hot water heaters bursting is when they're not properly protected. So, generally, you should make sure that:

- The shut off valve on your hot water heater is in good working order and that it's located near where the tank is installed. This will allow you to easily turn off the flow of water if there's a leak or other problem with your unit.

- Your drain for draining out excess water from your tank has a trap and isn't connected to any sewer pipes—this can cause serious problems if not done correctly!

How Do You Prevent a Water Damage?

You know how to prevent a water damage, so now you can put your new knowledge to good use. The next time you see those pesky puddles forming in the bathroom or kitchen, don't panic! Instead of reaching for the phone and calling SERVPRO of Nantahala NC, follow these 3 tips:

- Check the pipes between the furnace and hot water heater.

- Make sure your hot water heater is protected and up to code.

- Have insurance in place.

Hopefully, you have a better understanding of how to prevent water damage. As you can see, there are many things you can do to protect your home and prevent water damage from occurring.

Avoid Water Damage Claims With These 4 Maintenance Tips

6/25/2022 (Permalink)

Water damage in a building in Whittier, NC.

Water damage in a building in Whittier, NC.

Four Ways To Avoid Water Damage Claims

Filing a business claim after any water-related incident can help cover the costs while your Whittier, NC, location is repaired. However, there is a chance you may not qualify and still need to pay part of the bill. Additionally, the damage can interrupt or slow down your normal operations. Continue reading to learn how to prevent these events.

1. Shut Off the Valve After a Pipe Break

While a fast response to excess humidity or water is necessary, a leaking or broken pipe can quickly escalate to flooding. You and your employees should know where to locate and how to operate the building's main shutoff valve. Shutting off the valve can temporarily stop the water flow until the problem is resolved.

2. Keep Your Drainage System Clear

Your building's drainage system is essential for diverting precipitation towards a safe location. When leaves, branches and other debris block it, the water can build up and damage the roof and walls, necessitating a business claim. Regular inspection and cleaning of your gutters, downspouts and other drainage paths by experienced professionals can effectively prevent these situations.

3. Seal All Visible Cracks and Holes

The foundation of your building is not immune to cracks, gaps, and holes. These unplanned openings can allow water and high humidity to enter the building and affect anything inside. Additionally, freezing air can enter and damage the pipes, leading to more damage. Seal these breaches with caulk, foam insulation and weather stripping to protect your business.

4. Maintain the Building's Rooftop

A strong rooftop is crucial for the well-being of your property. Accumulated water or snow can weaken the structure and seep into the building, while the formation of ice dams can block your drainage and create further problems. Schedule inspections and maintenance by roofing professionals and keep track of the roof's load limits.

Although you will need a business claim to obtain help from a water damage remediation team, it is ideal to prevent this scenario. Enact the necessary strategies to keep your property safe from destruction.

Remember These 4 Things When Filing a Water Damage Claim

5/19/2022 (Permalink)

To save these residential floors in Franklin, NC from water damage, we put our floormats to work!

To save these residential floors in Franklin, NC from water damage, we put our floormats to work!

Filing a Water Damage Claim

If bursting pipes have created damage in your Tuckasegee, NC, home then you'll want to get compensation from your insurance company. After all, that's why you make those monthly premium payments. Here are some things to keep in mind when filing a claim.

1. Study Your Policy To Know What It Covers

Different insurance policies reimburse you for different types of damage, so the first thing you should do is read your insurance policy carefully to see what's covered. It's important to know what you're entitled to before you call the insurance company.

2. Contact Your Insurance Agent

When bursting pipes damage your home, let your insurance agent know as quickly as possible. You'll also need to save all receipts whenever you hire someone to fix a broken pipe or do other repairs on your home. Contact restoration specialists to repair any flooding damage and prevent the growth of mold. Document all of the work done.

3. Realize That Claims for Gradual Water Damage Are Often Denied

Damage to your home from bursting pipes is typically noticed right away and files are claimed. However, slow leaks from old pipes or cracks in the basement can bring on gradual damage. As a homeowner, it's your responsibility to maintain your home. If the harm is due to your neglect, the insurance company will likely deny your claim. Talk with your agent to see what is covered.

4. If Your Claim is Denied, Contact Your State Insurance Board

If your insurance company denies your claim and you feel you are entitled to be reimbursed, contact the state insurance board. They may be able to remediate the situation.

Damage to your home from a flood can be devastating, but by filing a claim and contacting the professionals as well as documenting everything, you can restore your home.

How Can Wet Documents Be Restored?

3/19/2022 (Permalink)

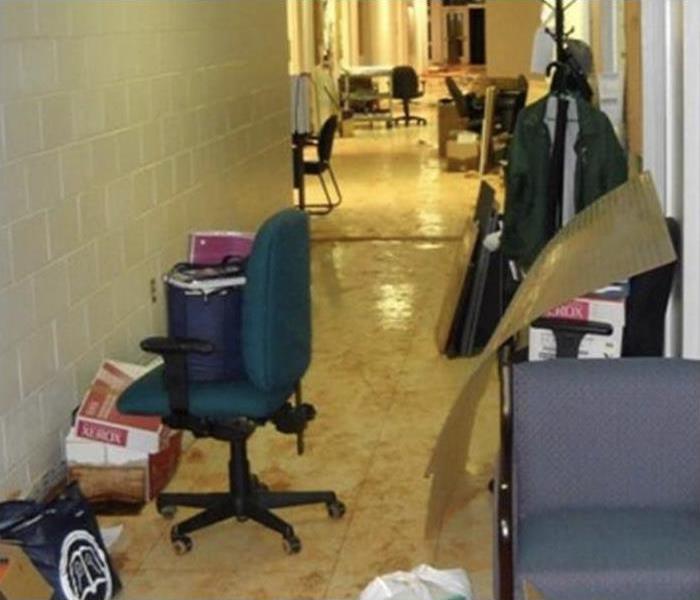

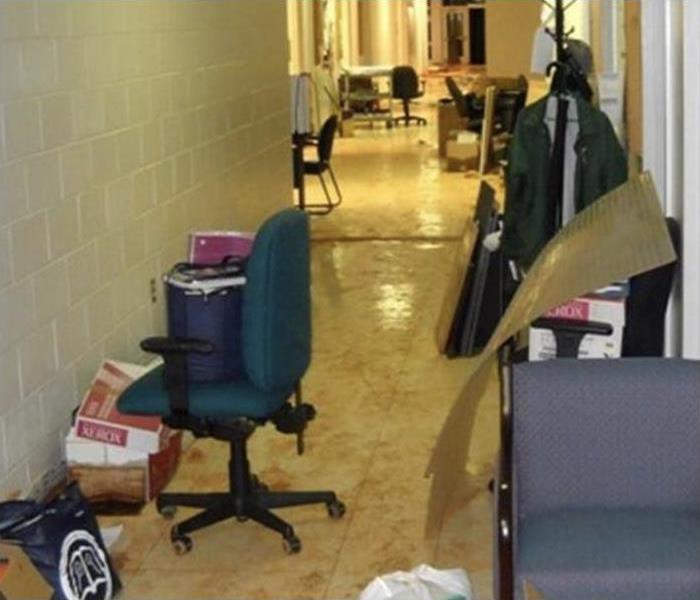

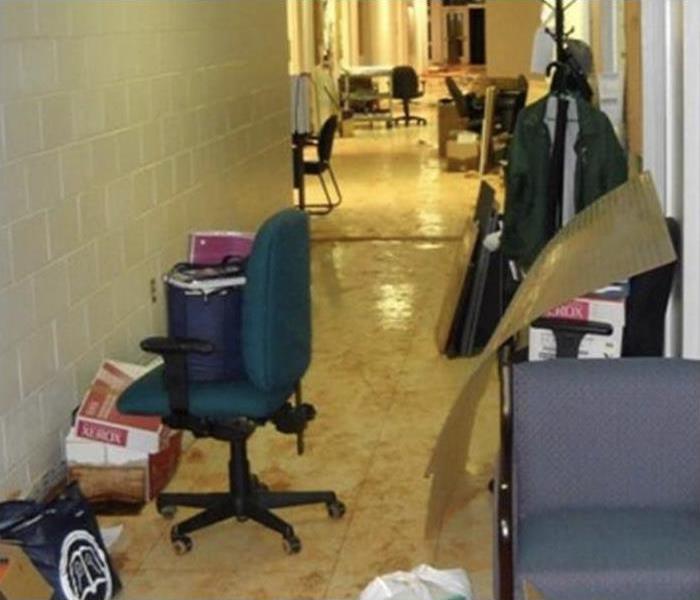

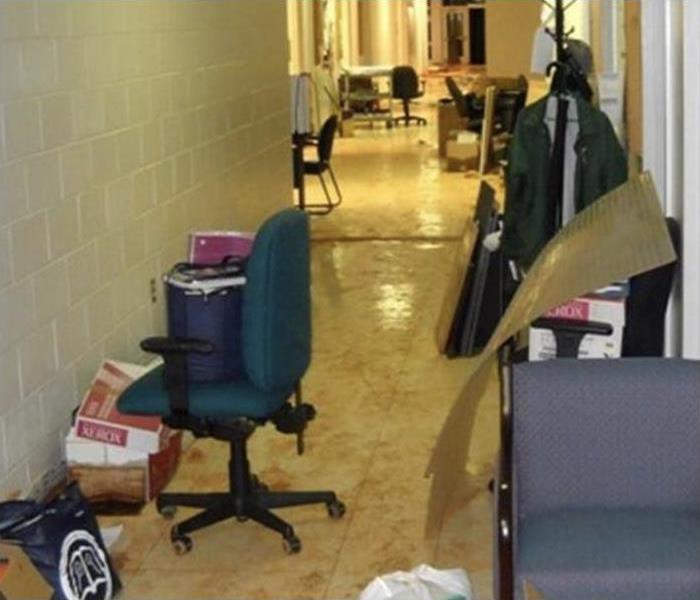

Floodwater causes damage to documents and contents inside an office building.

Floodwater causes damage to documents and contents inside an office building.

Water Restoration for Documents

If your building floods, there’s a chance that some of your most important documents could be damaged. Losing key records, original documents, books, and photos can be one of the most devastating effects of flooding. Fortunately, with specialized technology and innovative techniques, restoration professionals can often salvage and even restore wet documents.

1. Transfer to Restoration Facility

First, a document restoration team transfers wet and water-damaged documents to a secure restoration facility. These facilities are typically subject to 24-hour surveillance and are managed by HIPAA-Master-certified restoration technicians. Once they arrive at the restoration facility, water-damaged documents, and paper goods are carefully separated, inventoried, and cataloged to ensure nothing is misplaced or out of order.

2. Freeze-Drying

Next, restoration specialists use a unique vacuum freeze-drying process to dry the documents. This process is the same method that the U.S. Library of Congress uses for valuable books and historic documents and is the only document restoration process that is currently approved by the National Archives and Records Administration.

This specialized document drying technique can be used to safely restore many types of wet documents and paper goods, such as:

- Books

- Files

- Photographs

- Maps

- Magazines

- Manuscripts

- Blueprints

- Film and microfiche

- Parchment

- X-Rays

- Negatives

3. Gamma Irradiation

Most floodwater contains at least some contaminants, such as dirt, pesticides, bacteria, chemicals, and viruses. These contaminants may not be visible to the naked eye, but they can penetrate documents and cause ongoing damage. Restoration professionals use a state-of-the-art gamma irradiation procedure to clean, sterilize, and deodorize important documents without causing further damage.

4. Digitizing

Finally, the document restoration team carefully scans each document to create a high-quality digital copy. These digital versions are then added to the initial computerized inventory and cross-referenced, creating a convenient and searchable document catalog.

If a flooded building leaves you with wet documents, all is not necessarily lost. Contact an experienced document restoration company near Cashiers, NC, right away for the best chance at restoring these valuable items.

Flood Damage and Frozen Pipes: 3 Important Insurance Facts for

1/26/2022 (Permalink)

Drying up a house that has suffered from flooding.

Drying up a house that has suffered from flooding.

Learning the Details of Your Coverage

Investing in homeowner’s insurance can protect your Murphy, NC, home when unexpected disaster strikes. However, when it comes to flooding, you may worry about gaps in your coverage and which circumstances are covered. Some instances, such as flooding as a result of a burst water pipe during cold weather may allow you to file an insurance claim; however, it is important to understand what you can expect as far as how much of the damage will be covered and what you might have to pay for out of pocket.

1. Preventative Measures Can Affect Coverage

Some insurance companies require that you take preventative measures to prevent frozen pipes. For example, insulating them in cold weather and performing regular maintenance that keeps them in good working order may be necessary for filing an insurance claim in the event of a pipe break. It is wise to understand the terms of your insurance coverage so you can take steps to comply.

2. Affected Surroundings Are Usually Covered

Because water damage from a burst pipe can be significant, your homeowner’s insurance will likely cover affected surfaces such as ruined flooring, soaked drywall and wood cabinets. If any building material needs to be removed in order to access frozen pipes, you might be compensated for this too, especially if the temperature plummeted unexpectedly and you did not have the opportunity to insulate them.

3. Pipe Repair Costs Are Typically Not Covered

While your insurance company may help you cover costs for a flood damage and restoration service to come in and repair floors, walls and other structures, you will likely have to pay a plumber out of pocket when it comes to repairing the broken pipe itself. Since this can be a considerable expense, it is a good idea to have a plan in place and to retain the services of a trusted professional before this type of problem occurs.

Being able to file insurance claim when a frozen water pipe breaks and damages your Murphy, NC, home can give you peace of mind during such an incident. However, it is wise to learn the details of your coverage so you are prepared in the face of an indoor winter flood.

Water damage can wreak havoc on landscaping in North Carolina, leaving homeowners frustrated and unsure where to start the restoration process.

Water damage can wreak havoc on landscaping in North Carolina, leaving homeowners frustrated and unsure where to start the restoration process.

24/7 Emergency Service

24/7 Emergency Service